When Pam McClure discovered she’d save almost $4,000 on her pharmaceuticals subsequent 12 months, she mentioned, “it sounded too good to be true.” She and her husband are each retired and stay on a “very strict” funds in central North Dakota.

By the tip of this 12 months, she could have spent virtually $6,000 for her drugs, together with a drug to regulate her diabetes.

McClure, 70, is one in all about 3.2 million folks with Medicare prescription drug insurance coverage whose out-of-pocket remedy prices can be capped at $2,000 in 2025 due to the Biden administration’s 2022 Inflation Discount Act, in keeping with an Avalere/AARP research.

“It’s fantastic — oh my gosh. We’d truly be capable of stay,” McClure mentioned. “I’d be capable of afford recent fruit within the wintertime.”

The IRA, a local weather and well being care legislation that President Joe Biden and Vice President Kamala Harris promote on the marketing campaign path as one in all their administration’s best accomplishments, radically redesigned Medicare’s drug profit, known as Half D, which serves about 53 million folks 65 and older or with disabilities. The administration estimates that about 18.7 million folks will save about $7.4 billion subsequent 12 months alone because of the cap on out-of-pocket spending and fewer publicized adjustments.

The annual enrollment interval for Medicare beneficiaries to renew or swap drug protection or to decide on a Medicare Benefit plan started Oct. 15 and runs by means of Dec. 7. Medicare Benefit is the industrial different to conventional government-run Medicare and covers medical care and sometimes pharmaceuticals. Medicare’s stand-alone drug plans, which cowl medicines sometimes taken at residence, are additionally administered by personal insurance coverage corporations.

“We at all times encourage beneficiaries to actually take a look at the plans and select the best choice for them,” Chiquita Brooks-LaSure, who heads the Facilities for Medicare & Medicaid Companies, advised KFF Well being Information. “And this 12 months specifically it’s vital to do this as a result of the profit has modified a lot.”

Enhancements to Medicare drug protection required by the IRA are essentially the most sweeping adjustments since Congress added the profit in 2003, however most voters don’t learn about them, KFF surveys have discovered. And a few beneficiaries could also be stunned by a draw back: premium will increase for some plans.

CMS mentioned Sept. 27 that nationwide the typical Medicare drug plan premium fell about $1.63 a month — about 4% — from final 12 months. “Folks enrolled in a Medicare Half D plan will proceed to see steady premiums and could have ample selections of inexpensive Half D plans,” CMS mentioned in an announcement.

Nevertheless, an evaluation by KFF, a well being info nonprofit that features KFF Well being Information, discovered that “many insurers are growing premiums” and that enormous insurers together with UnitedHealthcare and Aetna additionally decreased the variety of plans they provide.

Many Half D insurers’ preliminary 2025 premium proposals have been even greater. To cushion the value shock, the Biden administration created what it calls an illustration program to pay insurers $15 further a month per beneficiary in the event that they agreed to restrict premium will increase to not more than $35.

“Within the absence of this demonstration, premium will increase would definitely have been bigger,” Juliette Cubanski, deputy director of the Program on Medicare Coverage at KFF, wrote in her Oct. 3 evaluation.

Almost each Half D insurer agreed to the association. Republicans have criticized it, questioning CMS’ authority to make the additional funds and calling them a political ploy in an election 12 months. CMS officers say the federal government has taken comparable measures when implementing different Medicare adjustments, together with underneath President George W. Bush, a Republican.

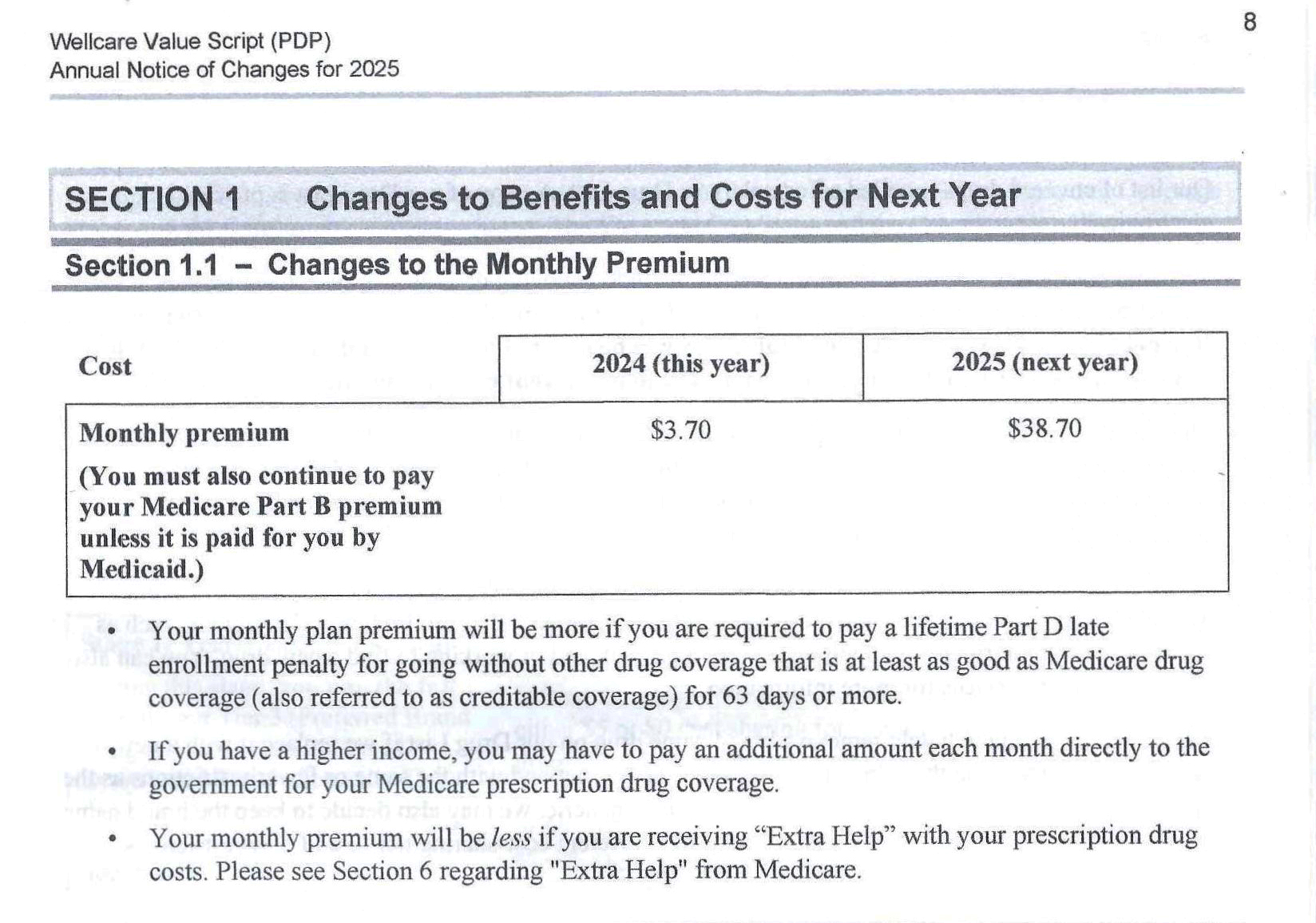

In California, for instance, Wellcare’s widespread Worth Script plan went from 40 cents a month to $17.40. The Worth Script plan in New York went from $3.70 a month to $38.70, a greater than tenfold hike — and exactly a $35 improve.

Cubanski recognized eight plans in California that raised their premiums precisely $35 a month. KFF Well being Information discovered that premiums went up for at the least 70% of drug plans provided in California, Texas, and New York and for about half of plans in Florida and Pennsylvania — the 5 states with essentially the most Medicare beneficiaries.

Spokespeople for Wellcare and its father or mother firm, Centene Corp., didn’t reply to requests for remark. In an announcement this month, Centene’s senior vice chairman of medical and specialty providers, Sarah Baiocchi, mentioned Wellcare would provide the Worth Script plan with no premium in 43 states.

Along with the $2,000 drug spending restrict, the IRA caps Medicare copayments for many insulin merchandise at not more than $35 a month and permits Medicare to barter costs of a few of the costliest medication instantly with pharmaceutical corporations.

It’ll additionally remove one of many drug profit’s most irritating options, a niche often known as the “donut gap,” which suspends protection simply as folks face rising drug prices, forcing them to pay the plan’s full value for medication out-of-pocket till they attain a spending threshold that adjustments from 12 months to 12 months.

The legislation additionally expands eligibility for “further assist” subsidies for about 17 million low-income folks in Medicare drug plans and will increase the quantity of the subsidy. Drug corporations can be required to chip in to assist pay for it.

Beginning Jan. 1, the redesigned drug profit will function extra like different personal insurance coverage insurance policies. Protection begins after sufferers pay a deductible, which can be not more than $590 subsequent 12 months. Some plans provide a smaller or no deductible, or exclude sure medication, normally cheap generics, from the deductible.

After beneficiaries spend $2,000 on deductibles and copayments, the remainder of their Half D medication are free.

That’s as a result of the IRA raises the share of the invoice picked up by insurers and pharmaceutical corporations. The legislation additionally makes an attempt to tamp down future drug value hikes by limiting will increase to the buyer value inflation price, which was 3.4% in 2023. If costs rise quicker than inflation, drugmakers should pay Medicare the distinction.

“Earlier than the redesign, Half D incentivized drug value will increase,” mentioned Gina Upchurch, a pharmacist and the manager director of Senior PharmAssist, a Durham, North Carolina, nonprofit that counsels Medicare beneficiaries. “The way in which it’s designed now locations extra monetary obligations on the plans and producers, pressuring them to assist management costs.”

One other provision of the legislation permits beneficiaries to pay for medication on an installment plan, as a substitute of getting to pay a hefty invoice over a brief time period. Insurers are imagined to do the mathematics and ship policyholders a month-to-month invoice, which can be adjusted if medication are added or dropped.

Together with huge adjustments introduced by the IRA, Medicare beneficiaries ought to put together for the inevitable surprises that come when insurers revise their plans for a brand new 12 months. Along with elevating premiums, insurers can drop coated medication and remove pharmacies, docs, or different providers from the supplier networks beneficiaries should use.

Lacking the chance to change plans means protection will renew routinely, even when it prices extra or not covers wanted medication or most well-liked pharmacies. Most beneficiaries are locked into Medicare drug and Benefit plans for the 12 months except CMS provides them a “particular enrollment interval.”

“We do have a system that’s run by means of personal well being plans,” CMS chief Brooks-LaSure mentioned. However she famous that beneficiaries “have the power to alter their plans.”

However many don’t take the time to match dozens of plans that may cowl completely different medication at completely different costs from completely different pharmacies — even when the hassle might save them cash. In 2021, solely 18% of Medicare Benefit drug plan enrollees and 31% of stand-alone drug plan members checked their plan’s advantages and prices in opposition to opponents’, KFF researchers discovered.

Free of charge, unbiased assist deciding on drug protection, contact the State Well being Insurance coverage Help Program at shiphelp.org or 1-877-839-2675.